boulder co sales tax efile

PdfFiller allows users to edit sign fill and share all type of documents online. Home Occupation Fact Sheet.

Sales Tax Campus Controller S Office University Of Colorado Boulder

350 Homemade trailer ID.

. If you need additional assistance. Proposed Sales Tax Extension. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. Check those invoices and receipts to ensure that the full tax rate City County RTD State of 8845 has been assessed and collected. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales.

On August 4 the the Boulder County Board of County Commissioners BOCC approved asking. As a statutory Town the Town of Eries sales tax is collected by the State of Colorado. In the example below the full tax rate has been.

You can print a 8845 sales tax. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. 15 or less per month.

About City of Boulders Sales and Use Tax. Sales tax licenses are required from both the city and state for businesses to operate in the City of Boulder. 417 Year Tab Replacement.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Get Your First Month Free. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

All businesses in the City are required to be licensed and must obtain a City of Louisville SalesUse Tax license. The current total local sales tax rate in Boulder CO is 4985. Please visit the Colorado Department of Revenue.

The current total local sales tax rate in Boulder County CO is 4985. 720 Title print only. E-File Your Tax Return Online - Here.

428 Year and Month. Return the completed form in person 8-5 M-F or by mail. State of Colorado Boulder County and RTD taxes are remitted to the State of.

Colorado has a 29 sales tax and Boulder County collects an additional. 400 Duplicate registration. Sales tax returns may be filed annually.

There is a one-time processing fee of 25 which may be. This is the total of state and county sales tax rates. The Boulder County Sales Tax is 0985.

Navigating the Boulder Online Tax System. This is the total of state county and city sales tax rates. The current 01 Transportation Sales Tax expires June 30 2024.

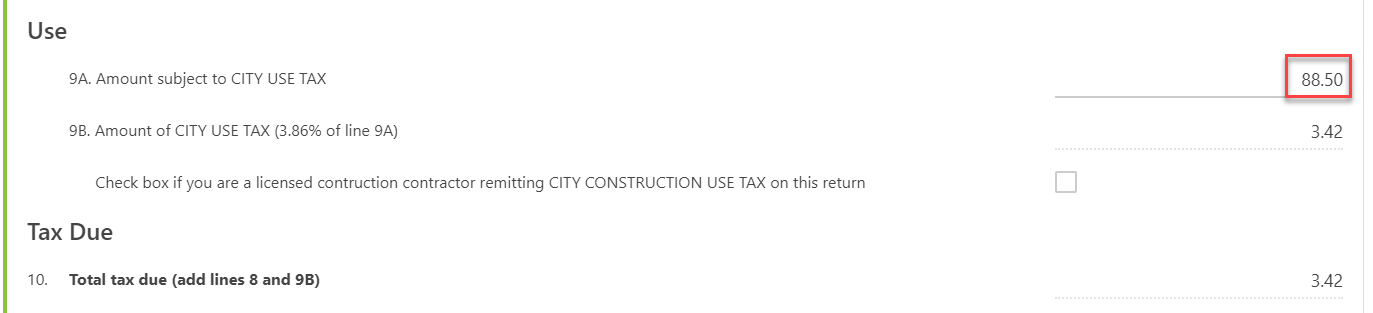

The Colorado sales tax rate is currently. Construction Use Tax is the salesuse tax paid by contractors or homeowners for construction materials used when erecting building remodeling or repairing real property. There are a few ways to e-file sales tax returns.

Sent direct messages to. Sales tax is a tax collected on all retail transactions. The December 2020 total local sales tax rate was also 4985.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Filing frequency is determined by the amount of sales tax collected monthly. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and.

Annual returns are due January 20. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. The minimum combined 2022 sales tax rate for Boulder Colorado is.

The December 2020 total local sales tax rate was 8845. 820 Duplicate title. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

What is the sales tax rate in Boulder County. For tax rates in other cities see Colorado sales taxes by city and county. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

Sales Tax Campus Controller S Office University Of Colorado Boulder

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Tax Reform Faqs Top Questions About The New Tax Law Bdo

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Bcor 2206 Economics Of Waiting Lines Operations Management Economics Management

Tax Accountant For U S Expats International Taxpayers Us Tax Help

File Sales Tax Online Department Of Revenue Taxation

Consumer Use Tax How To File Online Department Of Revenue Taxation

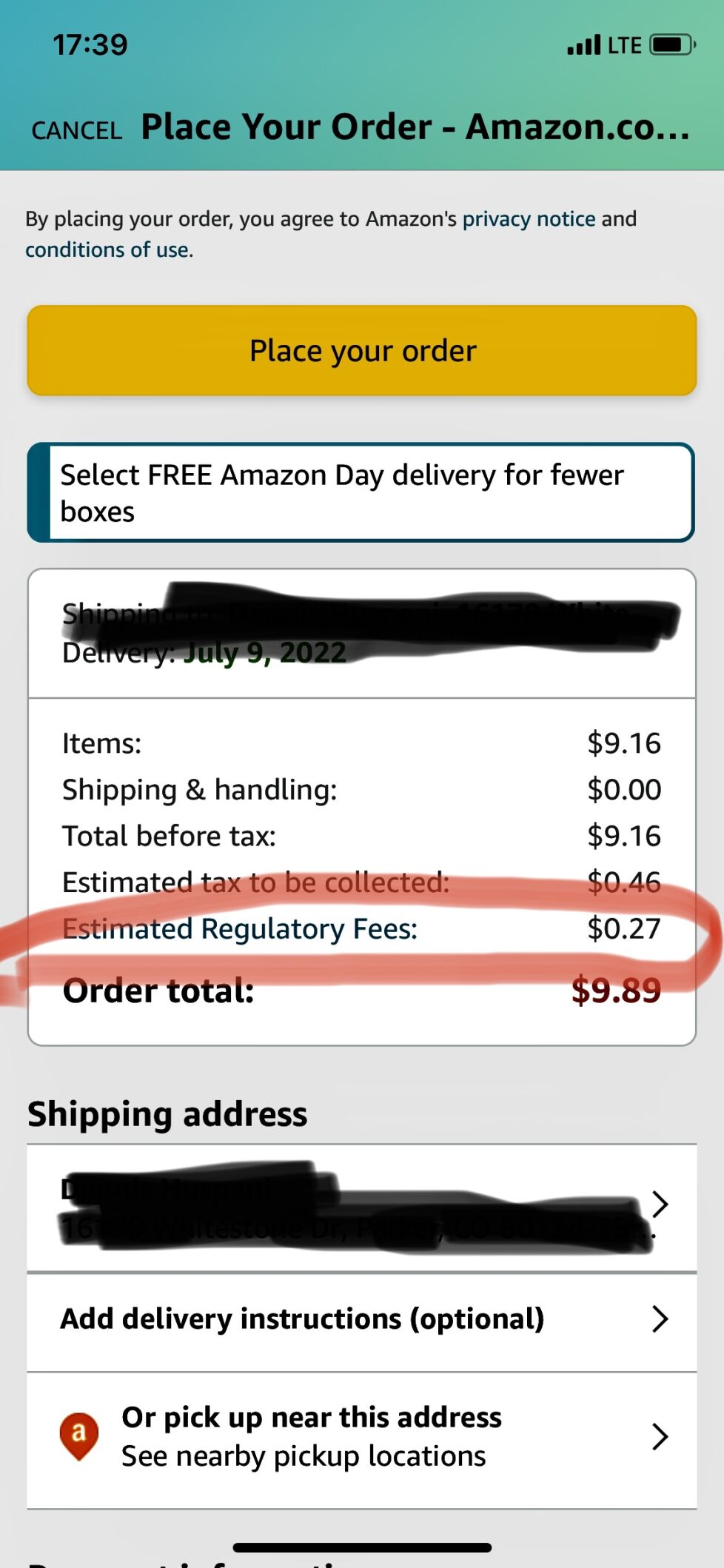

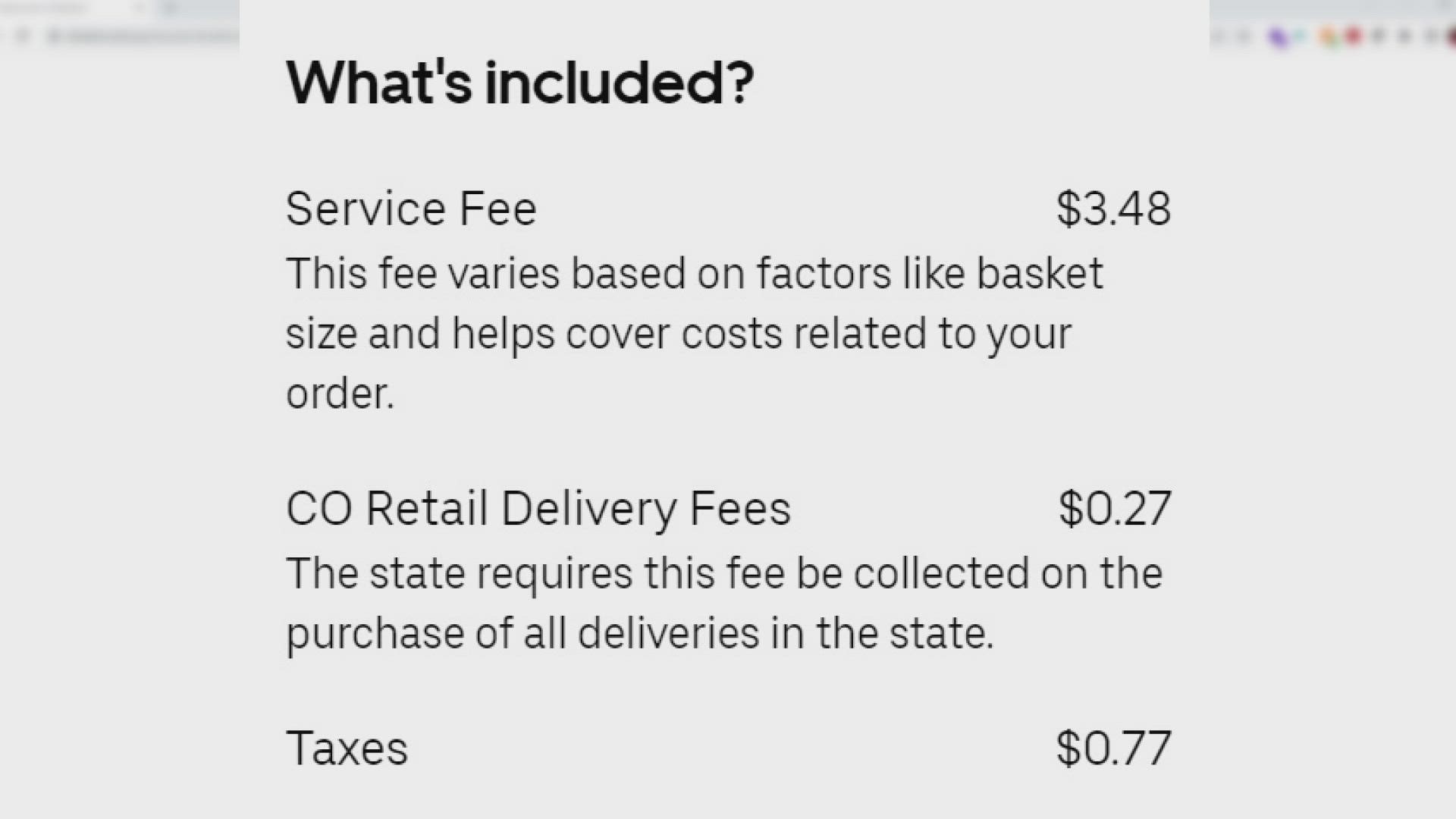

Confusion Swirls As Colorado Imposes New Retail Delivery Fee Catching Businesses By Surprise Business Denvergazette Com

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

File Sales Tax Online Department Of Revenue Taxation

Colorado S New 27 Cent Retail Delivery Fee Causes Confusion 9news Com